The latest edition of the Egyptian Center for Economic Studies’ (ECES) Business Barometer (BB) survey – released earlier this week – gives an assessment of Egypt’s economic and business performance in the second quarter of fiscal year (FY) 2018/2019 (October-December 2018).

Business Forward looks at the report highlights, focusing on the performance of large firms compared to small- and medium-sized enterprises (SMEs) during the quarter that witnessed a GDP growth of 0.1 percent, reaching 5.5 percent, a drop in unemployment rates to 8.9 percent, and the decision of the US Federal Reserve to raise the overnight lending rate to a range between 2.25 and 2.5 percent. Additionally, the budget deficit decreased from 3.7 percent to 3.1 during July-November 2018 year-on-year, according to the Ministry of Finance.

What do these major developments mean?

Egypt’s GDP growth is attributed to four main factors: extractive industries, construction, trade and communications, according to data from the Ministry of Planning, Monitoring and Administrative Reform.

While unemployment dropped in Q2-18/19, according to the Central Agency of Public Mobilization and Statistics (CAPMAS), the rates had previously witnessed a slight increase from 9.9 percent to 10 percent in the previous quarter. This is usually a seasonal downfall that occurs due to the new graduates entering the job markets.

The increase in the Fed’s overnight lending rate is believed to have put pressure on the monetary policy response in several developing countries, increase the volatility of capital markets in emerging economies and the cost of borrowing for highly indebted countries.

Although Egypt’s budget deficit decreased, it is still pressured due to factors including exchange rate risk and the volatility of global oil prices.

What about business performance?

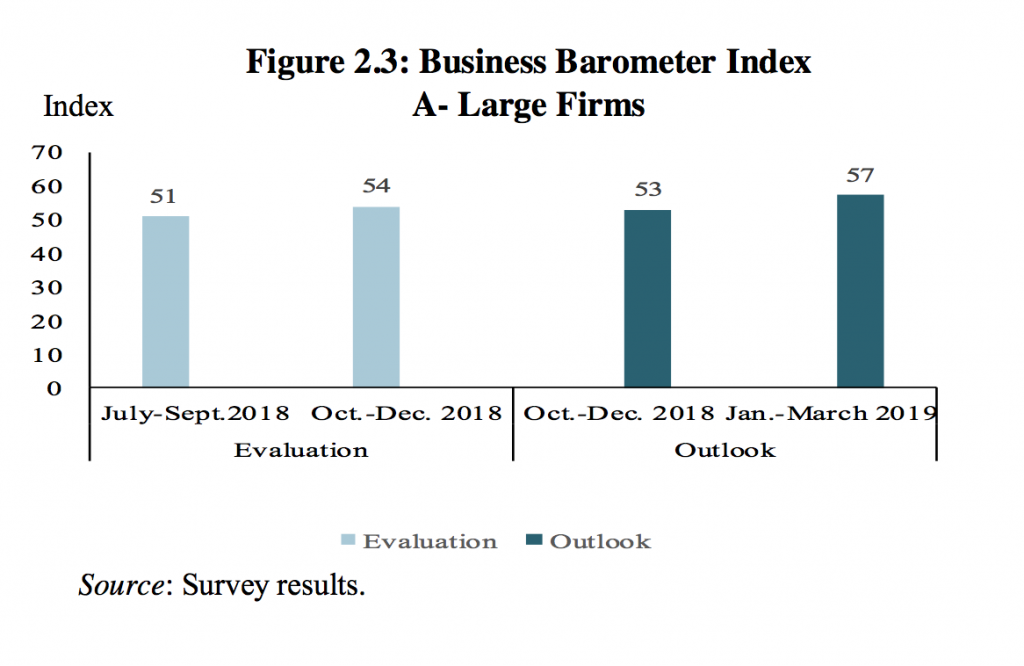

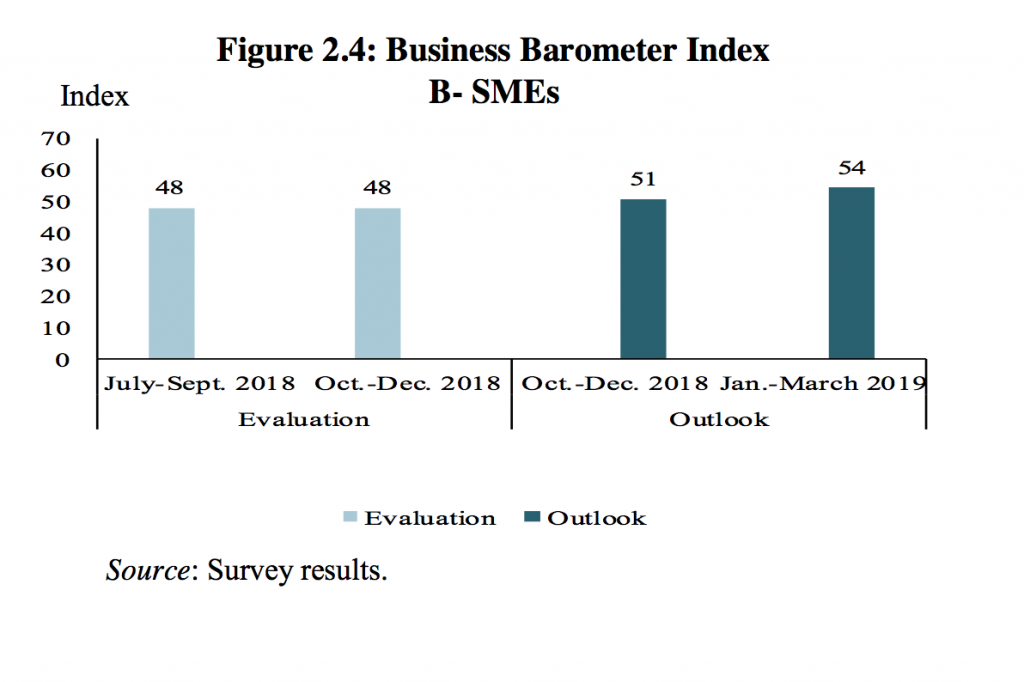

According to the BB’s methodology, a score above 50 means that the firms’ performance improved, while below 50 notes a decline in performance. Large firms and SMEs are evaluated separately.

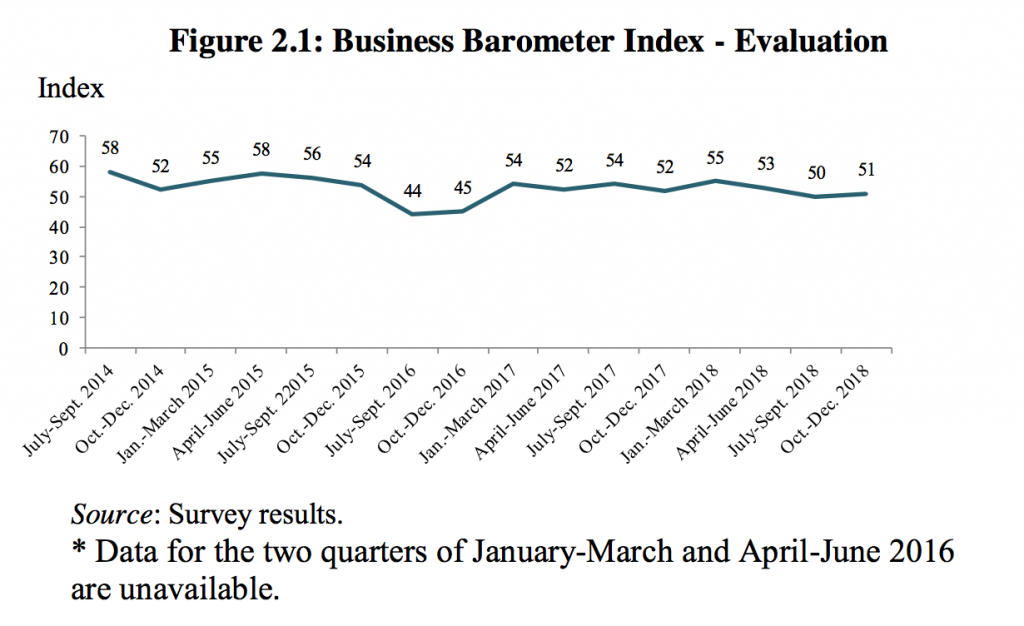

With that in mind, the BB notes a slightly higher collective business performance during Q2-18/19, expecting improvement in Q3. According to the survey results, the Business Barometer Index (BBI) reached 51 points.

The survey results also indicate that the performance index of large firms improved by three points compared to Q1, recording 57 points. The outlook index continued its upward trend for January-March 2019; thus, reflecting the ability of large firms to adjust to economic reform measures and their optimism about the reform process.

For SMEs, on the other hand, the survey results show a decline in performance to 48 points. This could be attributed to several domestic and global factors, such as more costly credit for SMEs, higher prices of raw materials and inputs and higher labor cost. Hence, providing SMEs with the support to help them endure the burdens of the economic reforms has become a necessity. However, SMEs are still optimistic about an improvement in Q3, confident to receive support from the state.

While economic activities and growth for large firms have improved, and accordingly reflected on their domestic sales and exports, the situation for SMEs was different. The performance evaluation results for SMEs were weak, reporting lower domestic sales and exports.

What else do we know?

According to the views of the business community at the sectoral level, the communications sector improved the most in the quarter under review, which may be attributed to the increased automation of government services such as in the taxes and real estate registration areas.

The survey results further indicate that the investment index for both large firms and SMEs has improved during the second quarter. This could be attributed to the business confidence in the reform efforts and the government’s efforts to ameliorate the investment environment, according to ECES.

Expectations for Q3: Business strategy going forward

Regarding large firms, there are expectations of an upward trend for economic growth throughout the third quarter – a more optimistic outlook than in the second quarter. For SMEs, the forecast shows a slight increase in economic activities; however, at a slower pace than during Q2.

At the sectoral level, the outlook for Q3 is positive in general, specifically for the communications sector. These positive views also encompass the tourism, manufacturing and transportation sectors.

The financial services sector is also looking positive, given the government’s announcement of planned placements in the stock market during the fourth quarter of 2019.

Where are the business constraints?

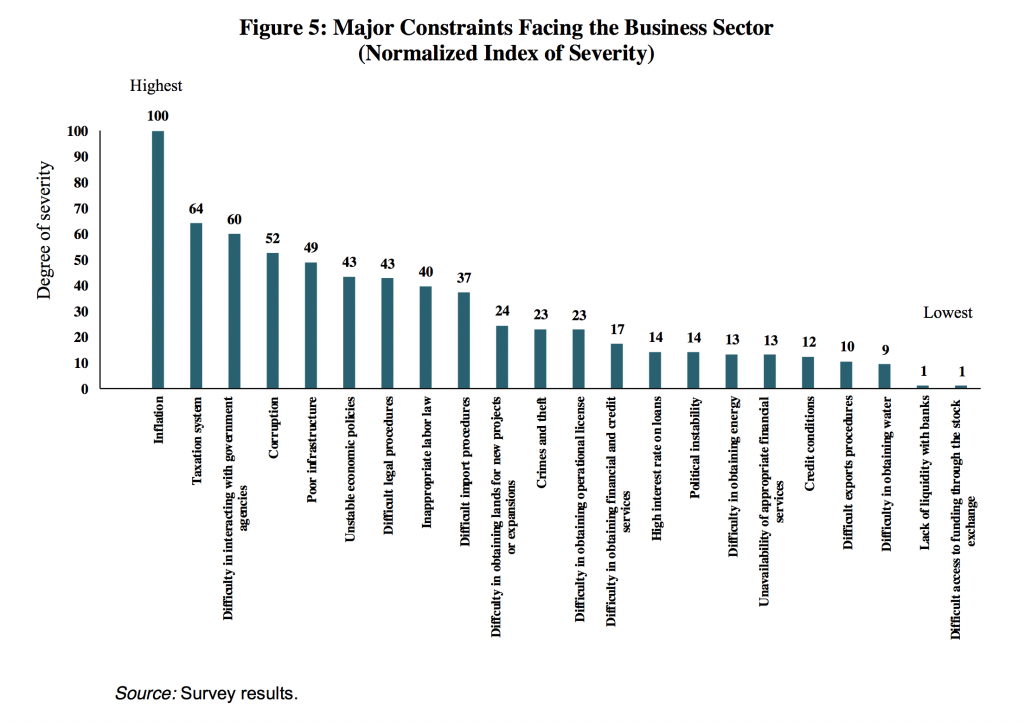

Though inflationary pressures and the tax regime are deemed the biggest obstacles for business, dealing with government agencies and corruption remain a major obstacle to the performance of business in Egypt. Hence, the BB suggests that the government needs to adopt institutional reforms in order to uphold the efforts of the economic reform program.