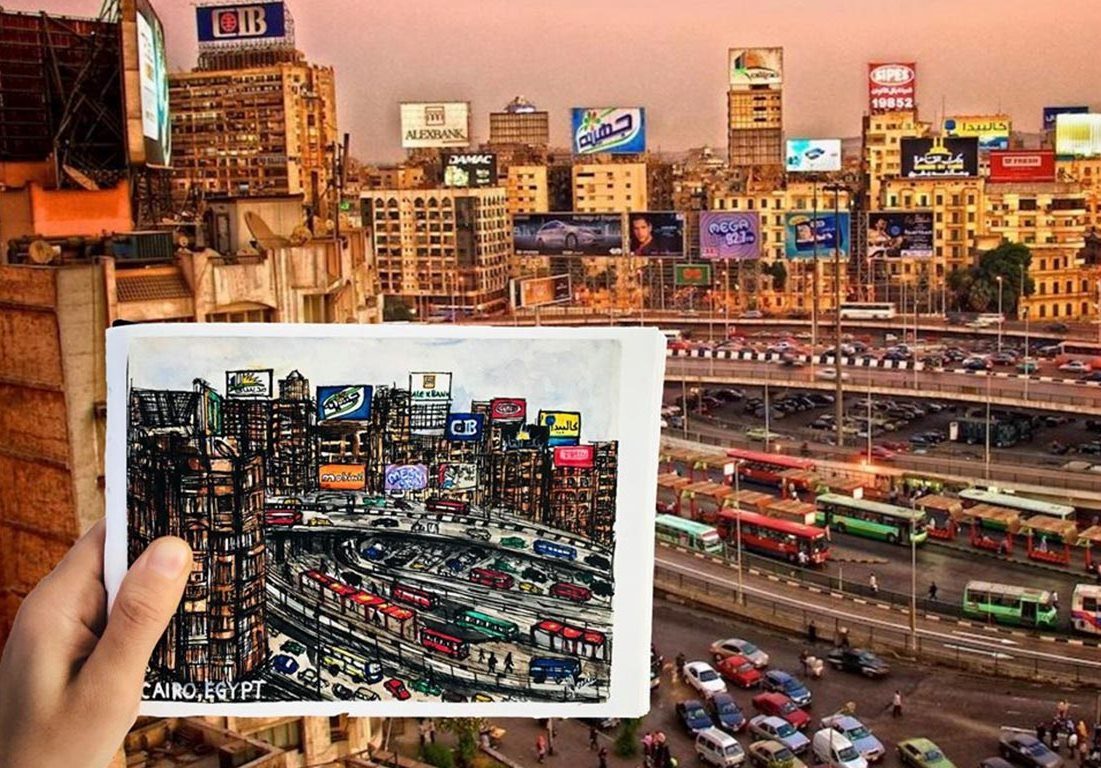

Photo by Hania Sedky

Humorous . Creative. Sometimes too distracting. These are all things people often say when they come across Out-of-home ads (OOH), known to most as billboards. If you live in Cairo, then it would be hard to overlook how the OOH industry has grown over the past decade; from a few billboards here and there on major highways, to almost every street corner where it’s physically possible to have a billboard up.

What most don’t consider is that the OOH industry is a vital and dynamic economic sector. Not only does it employ thousands of people, most of whom are daily-wage workers, but it also mirrors the overall state of the economy. That is because the more companies and businesses grow their economic activities, the more budget and willingness they have to advertise their projects.

“This is an extremely fragmented and layered market. There are 100s of AdSpace owners and agencies in Egypt,” says Assem Memon, managing director of AdMazad, a prominent research agency specialized in OOH advertising in Egypt. “We estimate the annual turnover of the OOH industry in Egypt to be EGP 6 billion; among which expenditure in Greater Cairo amounts to over 70%. This was driven by the continuous upgrade in supply that happened in Cairo over the last 5 years.”

COVID-19 impact

But with curfew measures sweeping the country in the wake of the spread of COVID-19, most roads and streets are now practically empty for almost half the day, with the other half witnessing reduced traffic due to many companies and institutions adopting working from home. That, in addition to critical customers of the OOH industry, like real estate, seeing major slowdowns in their activities, has subsequently led to a dramatic slowdown in the OOH industry.

“Our traffic measurement tools have shown over a 45% decline in daily congestion, resulting in shorter ad viewer time (dwell time), as well as an estimated reduction of daily traffic by over 60% resulting in a significant reduction in impressions,” explains Memon. “In May 2020, the number of vacant billboards in Cairo almost quadrupled when compared to May of 2019; this is the 3rd continuous month of decline with the vacancy rate reaching 59% in May, up from 51% in April.”

“For the last five years, the main driver of OOH usage was real estate advertising; in 2019 they represented over 40% of the entire market utilization,” adds Memon. “As long as real estate expenditure does not recover, we shall not have a full recovery. That said, the last 18 months have seen a surge in advertising from local and international tech companies, be it large organizations like Google or local success stories like Wuzzuf or Vezeeta.”

Has OOH expenditure been directed to other mediums of advertising (i.e. social media or TV)?

It would be an easy assumption that instead of putting it on a billboard that not many will see, let’s put on social media which is in everyone’s pocket. However, there are other factors that play into this.

“We have to look at the crisis with a wider perspective,” says Shaheer Farag, managing director of Results Media agency, to CNBC (full interview below). “For someone to put an ad anywhere, no matter the medium, they have to have a functioning business that continues to operate and produce unaffected by the pandemic. It will be a question of what coping strategies will be adopted by businesses across different sectors, which will then determine their expenditure on advertising through all mediums.”

On the other hand, though no significant increased expenditure was recorded in other mediums, some companies which exclusively provide OOH ads are now looking into expanding their operations in the wake of the pandemic-inflicted slowdown, seeking to diversify their operations and revenue streams to mitigate similar scenarios in the future.

“We’re working on launching a section dedicated to social media advertising,” says Ahmed Kotb, CEO of AdStore, a marketing and advertising company. “We’re also considering expanding our operations into other sectors, like industrial or agricultural sectors, so that we have a Plan B in case there’s another slowdown in advertising.”

Road to recovery

While important industrial and hospitality sectors have naturally received the bulk of government support in the wake of the pandemic, the OOH industry is yet to get the same attention. It’s not, however, direct financial support that is being sought by the industry.

“On the COVID-19 front and the market crash, a more flexible and smart licensing fee mechanism, that is more focused on revenue sharing and not on guaranteed revenues, will help concession and media owners in reducing their overheads until the market recovers,” explains Memon, adding that the sector is already witnessing a partial recovery as of June, further expecting that a return to figures similar to 2019 won’t be before the fourth quarter of 2020.

Agreeing with Memon, Kotb adds that OOH advertising companies also have a role to play in recovery.

“In addition to lowering licensing fees at least for a while, companies need to look into lowering pricing and profit margin – or removing it altogether – so that customers are encouraged to do OOH ad campaigns again and move the sector forward.”