Establishing a successful business is hard, but making it last across generations engulfs a whole other level of difficulty.

From deblurring the lines between family and business to effectively preparing the next generations to pick up the baton, business owners are bound to face their fair share of challenges – which could wreck inter-family relationships and undermine the business, if not managed properly.

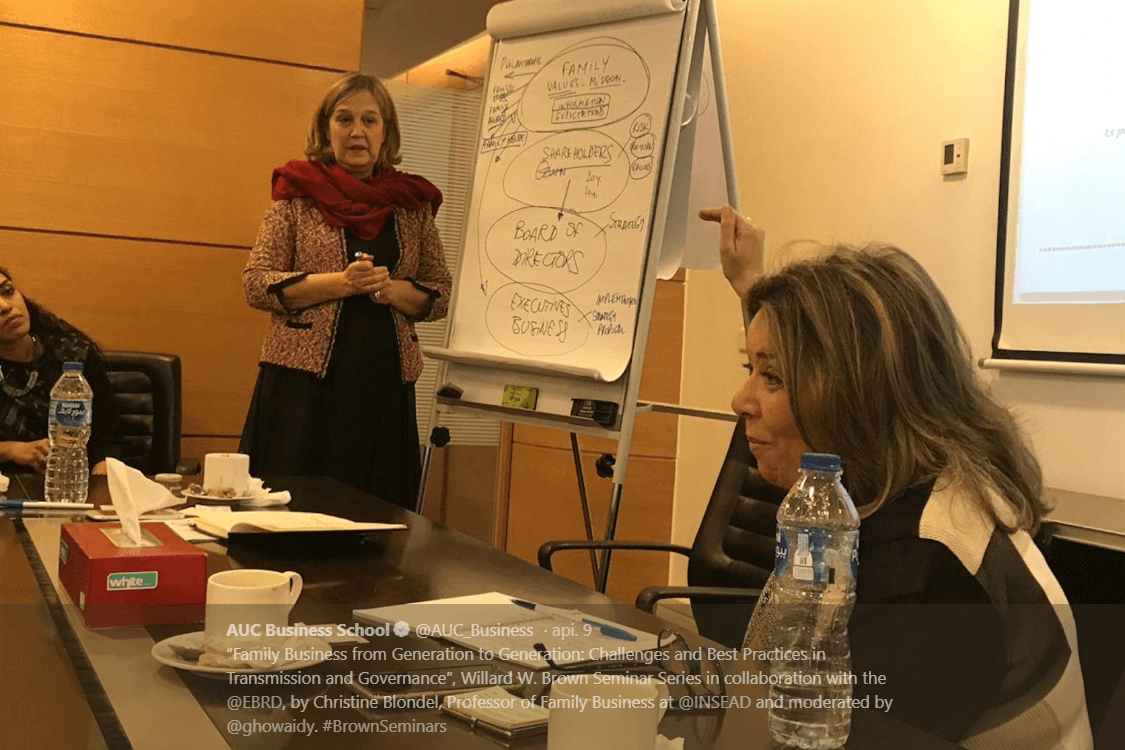

Business Forward spoke to professor of Family Business at INSEAD Christine Blondel about how to overcome common challenges that might hinder the growth of family-owned businesses, the importance of having a properly composed board of directors and the trade-off between traditional business stewardship and entrepreneurial mindset.

Blondel was granted the Family Firm Institute Interdisciplinary Achievement Award in 2017, after she spent almost two decades working and teaching about family-owned enterprises. She was also the first executive director of the Wendel International Centre for Family Enterprise at INSEAD.

Nepotism as a recipe for disaster

In family businesses, the challenges that seem to be most prominent include not having the right people managing the business and the forcible induction of family members into the business, Blondel says. She adds that the lack of an effective system of accountability messes with the business.

““In some cases, business leaders take bad business decisions– or lack the needed reactivity – without being challenged. Nepotism would rear its ugly head if it gets deeply entrenched in the business.

Blondel says that there are some other situations in which founders place their children at the head of the company, without taking the successor’s personal dreams or competencies – as in knowledge, skills and attitude – into consideration. Hence, this may affect the second generation’s work ethics, values and motivation – and ultimately, the way they work.

“If a family employee consistently arrives late or does not care, he/she does not pose a good example in conveying the right family values,” Blondel comments.

Hence, a proper hiring structure and corporate governance strategy should be in place.

Increasing transparency between shareholders and family leaders

Shareholders often feel unheard within family businesses – even if they are family members.

The fear of being unable to smoothly set forth one’s own vision for the company is one of the factors that drive business leaders when they deal with the shareholders.

“Those in charge think that if they train the shareholders too well, then the owners would not be able to do what they want,” Blondel explains.“But trained shareholders understand the business much better.”

For instance, if the business needs to re-invest money, trained shareholders will understand that the money is needed for the business, not for dividends or the shareholders.

Placing external members at the top echelons to avoid “blind spots”

Setting up a company’s board that includes non-family members is a good place to start strengthening the business, she recommends, as it helps cover blind spots in the business.

“These external board members should make the CEO accountable, ask whether the CEO is a family member or not, make sure the business has a strategy, follow up on the budget,regularly have shareholders’ meetings and informal meetings with the family members.”

One of the board’s roles is to ensure that the culture of the organization allows family and non-family members to be treated alike, Blondell points out. However, the family members sitting on the board of directors also need to make sure that the family’s values are enacted in the business.

For that, family members need to agree on their set of values and be consistent in their implementation.

Entrepreneurship as part of “the family legacy”

“Very often, innovation comes from openness. Hence, as a family business, be open to new opportunities from the next generation and from external board members,” Blondel says.

In times of fast-paced disruptive change, many family businesses may be vulnerable in the face of innovation-driven development. Here is where business owners need to figure out how to nurture therisk-taking approach based on the family’s traditional business.

“One of the family’s values should be entrepreneurship, just as much as integrity and honesty. ,”Blondell tells Business Forward.

She recounts how some family businesses established an annual entrepreneurship reward for the most interesting project. These awards consider philanthropic efforts and startups.