With the final tranche of the International Monetary Fund’s (IMF) Extended Fund Facility receiving the green light, Egypt is on its way to conclude a major phase of its economic reform program.

Through its report “Half empty or half full: Egypt’s economic outlook,” Dcode for Economic and Financial Consulting takes a look at whether the country attained the targets that were supposed to be achieved through the economic reform program or not.

Pre-2016

Before 2016, economic growth declined, remaining positive mainly due to consumption spending. This was accompanied by largely double-digit overall fiscal and current account deficits. Growth was driven by government spending and the notion of a low national savings ratio started to get comfortable.

In 2016, real action toward economic reform took place – the value-added tax (VAT) was enforced, subsidies on fuel were cut, new laws were introduced to mitigate the investment and business climate, the local currency was floated, interest rates rose and social safety nets expanded.

Along with agreeing to a $12-billion loan, the IMF set expectations for key economic performance indicators in Egypt in a report with the Ministry of Planning.

So how well did Egypt do, after taking rigorous steps towards reform? Here are the graphs that tell us more.

Economic growth

In terms of real GDP growth, Egypt topped expectations in the past two fiscal years, while investment and net exports became the major contributors.

Current account

“Growth in private remittances, non-oil exports and tourism have provided strong support to the current account, bringing it down by 3.5 [percentage points] of GDP in two fiscal years ending 2017/18,” Dcode states in its report.

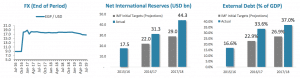

Net international reserves, foreign exchange and external debt

With an overshoot in the foreign exchange rate of the Egyptian pound against the US dollar, net international reserves replenished at a faster rate than expected. Similarly, the country’s external debt rose to levels that exceeded the projections by over 13% in 2017/2018.

Budget deficit

While the budget deficit definitely decreased, projections of the IMF were rosier in that regard. It is worth mentioning, though, that the country’s primary surplus hit 0.2% of the GDP in 2017/2018 – this was the first time that the indicator went from deficit to surplus in 15 years.

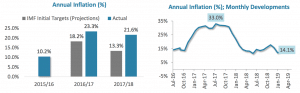

Inflation

“A 48% cumulative increase in prices in 2016/17 and 2017/18 has left households with a significant erosion in real purchasing power,” Dcode explains. However, inflation is slowly but surely approaching lower double-digit levels. Projections still seemed milder than reality.

Collectively, Egypt exceeded the projections in terms of economic growth, the current account deficit and net international reserves. However, it lagged in terms of external debt, budget deficit and inflation.

“We expect growth to slow down to an average of 4.6% in the next three fiscal years,” Dcode concludes.