In a Business Forward exclusive, Sherwat Elwan, associate professor of operations management and the director of the MBA programs at the American University in Cairo (AUC) School of Business, details the implications of the Suez Canal blockage from a supply chain management perspective.

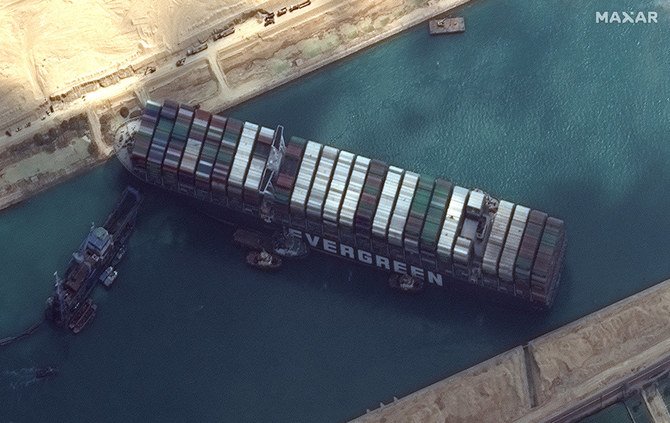

Egypt followed anxiously since Tuesday March 23 as news of the massive container ship Ever Given getting stuck between the Suez Canal banks made it to the top headlines of the world’s biggest news outlets and took over social media attention. The Suez Canal Authority (SCA) had stated that daily losses due to the blockage are estimated to be around $12 to $15 million, a reminder of the vitality of the waterway to the Egyptian economy. For days, the SCA lead a huge effort to pull the giant vessel out of the waterway via tugboats until it was finally freed on Monday March 29 into the Bitter Lakes for further inspection, freeing more than 400 ships who were jammed in the process.

The incident is also a reminder of how maritime transportation shapes the bulk of international trade (around 80 percent, according to UNCTAD), as it is cheaper than other modes of transportation. The Suez Canal is a passageway for about 12 percent of global trade, according to the World Economic Forum.

How can we explain trade interconnectedness using the example of the Suez Canal blockage by the Evergreen-operated container ship?

Everything is very interconnected. For example, geographically, what happened to the Suez Canal in Egypt affects other continents such as Asia, Europe, and Latin America. Due to the Suez Canal blockage, reefer containers have not been able to get to Latin America so the prices of reefers in Latin America have gone up. This can be compared to what happened with China during the beginning of the pandemic. When China closed due to COVID-19, 20 percent of the container supply worldwide was in China and it could not get out. This shows how everything is connected, and everything affects everything else. However, some things, like an Asia-US or India-Far East Asia trade would not be affected. Overall, trades that do not go through the Suez Canal are not going to be affected, but the multitude of trades that depend on the Suez Canal will be, due to their interconnectedness.

What was the immediate impact of this incident on global supply chains, prices of goods, on oil prices?

The immediate impact was huge, everything going from Asia to Europe stopped for a whole of seven days. Anyone without a big enough safety stock got completely dismantled. Prices of goods had no immediate change, and it could take a couple of weeks to understand any changes of the price of goods. Oil prices did go up (around 6 dollars). The safety stock will not change in the long run, as this event is seen as a one-time thing. The only time something similar happened was around 20 years ago but with the amount of disruption happening during these past couple of years, companies need to revisit their risk strategies.

Video by Moustafa Daly

Who appear as winners and losers out of this crisis?

Due to the increase in oil prices, the oil and gas industry appears as a winner. Many losers can be seen among which appear are shipping lines, reefer containers industry, final customers, the Suez Canal itself, and many more.

As this crisis detangles, does it leave any longer-term implications on the shipping industry and trade routes?

No, the rate increases that occurred are predicted to decrease again and are not expected to be permanent in the long run, due to Suez Canal blockage.

Improving supply chain resilience through redundancy and buffer stocks is an ongoing discussion on the agenda of many top companies and academic research, especially local sourcing strategies that would allow for more agile supply chains. This includes the development of new closer suppliers.

The article has been last edited on April 3, 2021.