When it comes to creating a fair and thriving society, one essential path lies in empowering women to actively contribute to inclusive growth, especially in the realm of finance. It is not only a matter of doing what’s right but also what’s smart in terms of recognizing the strategic importance of investing in women.

In December 2023, the third report resulting from the collaboration between the Subregional Office for North Africa of the Economic Commission for Africa (ECA) and Oxford Economics Africa, headquartered in South Africa, was issued under the name “Gender-smart Investing for Inclusive Growth in North Africa.”

The report served as a study investigating both the entrepreneurial and the small to medium-sized enterprises (SME) landscapes across the North African region, with a specific focus on the role being fulfilled by women. The analysis is complemented by an assessment of how policies and other initiatives such as gender-smart investing can be leveraged to address social gaps – particularly gender inequality – towards the ultimate goals of accelerated economic growth, development, and job creation.

Generally, the report recommended that development finance institutions (DFIs), International Finance Institutions (IFIs), international actors, and impact funds can expand their footprint in countries such as Egypt, Morocco, Tunisia, Algeria, and Mauritania. “These stakeholders should adopt a holistic approach which extends beyond simply providing women with access to capital. The private sector should be also incentivized to boost interventions in support of female-owned businesses and entrepreneurs. A value-chain approach often works well in this regard by sourcing from female-owned businesses and providing them with financial, training, mentoring and broader support mechanisms,” said the report.

It summed up its recommendations in six salient points. The question here: based on these recommendations, what progress has been made so far in Egypt? And what is still lacking? Adjunct Faculty and Chief of Party of USAID Egyptian Pioneers at the American University of Cairo (AUC) and who also participated in the report launch, Amal Mowafy, argues that the recommendations “provide the necessary but not sufficient conditions, taking Egypt as a case in point.” She adds, “as a matter of fact, the Egyptian National Council for Women (NCW) has put in place a women economic empowerment strategy in 2015 with clear targets to be realized by 2030.” Within this framework, Mowafy shares her expertise and recommendations to help refine the findings of the report and explores the progress made in Egypt on each of the six recommendations.

1. Enhanced policy focus on female entrepreneurship and SMEs

The aforementioned strategy put forward by the NCW specifically aims to “develop women’s capacities to enhance their employment options, expand their participation in the workforce, support their entrepreneurship, and realize equal opportunities for women’s employment in all sectors. That includes holding senior positions in both the public and private sectors.

Two very relevant indicators show a doubling in the percentage of small enterprises managed/owned by women from 22.5% to 50% and a significant increase in micro-financing targeting women from 45% to 53% from 2015 to 2030.

The strategy also ensures that policies are developed to ensure: a) the private sector is committed to the proper representation of women on their boards of directors; b) the diversity of economic sectors established in different governorates, and industries that can create direct and indirect job opportunities for women’s employment within their value chains are attracted; c) procedures that encourage women to set up their own private businesses are activated; and d) business development services targeting.

2. Improved policy alignment

In Egypt, Investment Law 72/2017 and SME Law 152/2020 is just one example, among many, of improved and aligned policy governed by the principles of “equality of the investment opportunities and equal opportunities regardless of the size and location of the project and without discrimination on the basis of gender.”

Other examples are the Financial Regulatory Authority’s (FRA) regulatory decrees which are set to help in implementing the National Strategy for the Empowerment of Egyptian Women 2030, which targets a 30% share of senior management roles for women by 2030.

3. Support from a wide range of stakeholders

In this regard, if we look at the private sector, the UN Women Empowerment Principles (WEPS) have already been adopted by 86 companies in Egypt including FRA, which is the first regulatory body to sign this declaration. Additionally, the Egypt Women on Boards Annual Monitoring Report 2022, produced by the AUC Women on Board Observatory, results also marked another milestone in achieving the 30% women on boards’ goal. The 2022 women on boards indicator reached 19.7%, witnessing an increase of 3% compared to 16.7% in 2021. Sustaining the 3% annual increase pattern achieved in the past three years will enable the analyzed categories to reach the 2030 strategy goal of 30% women on boards by 2026.

In terms of DFIs, the Women Entrepreneurs Finance Initiative (We-Fi) is a global partnership launched in 2017 that aims to provide financial and technical assistance to women-led small and medium-sized enterprises (SMEs) in developing countries. Through its funding and partnerships, We-Fi provides grants, loans, and technical assistance to women-led SMEs, as well as to organizations that support female entrepreneurs. The initiative also works to promote policy and regulatory reforms to create a more enabling environment for women’s entrepreneurship.

In Egypt, We-Fi has played an important role in supporting the growth and development of women-led small and medium-sized enterprises (SMEs). It has also partnered with the International Finance Corporation (IFC) to provide funding and support to female entrepreneurs in Egypt, with a focus on sectors such as tourism, agribusiness, and technology.

Moreover, We-Fi has supported policy and regulatory reforms aimed at creating a more enabling environment for women’s entrepreneurship in Egypt. For example, in 2019, We-Fi supported a project aimed at increasing women’s access to finance in Egypt by working with the Central Bank of Egypt (CBE) to develop a strategy for promoting gender-inclusive finance.

4. More than just finance

As the report mentions, barriers to access to finance are lower in Egypt and Morocco compared to other MENA countries. As a matter of fact, Micro, Small and Medium Enterprise Development Agency (MSMEDA) has made some achievements in terms of empowering women economically. That includes providing 648,610 loans for small and micro enterprises, 30,000 loans for small businesses and 618,400 loans for micro-enterprises. In addition, 741,182 job opportunities were created in all governorates and about 24,000 women were trained on entrepreneurship skills, along with 2000 women on handicrafts and heritage industries.

5. DFI’s, private sector and investors can expand North Africa intervention

The Arab Women’s Enterprise Fund (AWEF) conducted a digital survey covering 21 Egyptian firms. It assessed female representation at the board, senior management and employee levels, recruitment retention and promotion policies, female customer-targeting mechanisms, and representation of women-owned SMEs within value-chains. The survey shows that there are latent commercial benefits from engaging women more proactively as producers and consumers. The survey also provided evidence that female-owned businesses within firm’s supply chains are perceived to be very reliable, creative and innovative.

6. Shift social perceptions on the role of women

The year 2017 was dedicated to Egyptian women. Since then, many laws or amendments to existing laws were introduced to criminalize Female Genital Mutilation, sexual harassment, cyber bullying, child marriages and violence against women. Working Women’s Service Centers were established with the aim of encouraging women to participate in the labor market. There are now 41 centers in 22 governorates, and 195,000 beneficiaries. Development and expansion of nurseries for working women’s children has also taken place, in order to ensure investment in early childhood. In addition to that, the NCW is constantly launching various women awareness campaigns in each village.

So what is the outcome?

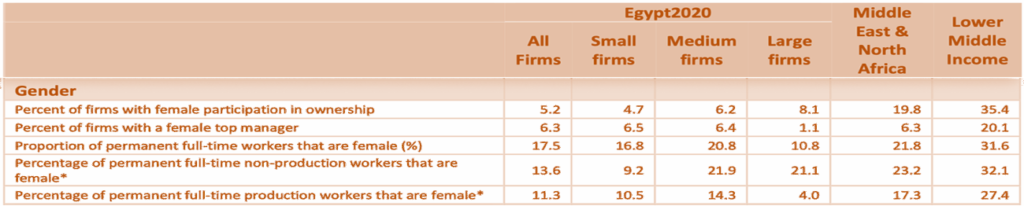

To conclude, with the six salient recommendations being put to implementation since 2015, female participation in ownership is deemed comparatively low in Egypt’s case, irrespective of firm size, when compared with the other North African countries.

While percent of firms with a female top manager is at par with the MENA level and both the country and sub-region are well below lower middle income countries.

Source: World Bank – Enterprise Surveys – Egypt Country Profile 2020

Over 80% of micro and small enterprises (MSEs) in Egypt operate in the informal economy. Most women entrepreneurs owning Micro Small Enterprises are also concentrated in the informal sector. An ILO report indicates that 73% of the 200 women entrepreneurs surveyed had not registered their enterprise (ILO, 2017).

What comes next?

Amal Mowafy stresses that ‘gender forward policies’ need to be formulated based on evidence while being informed by evolving global trends and structural transformations (green transition, technological change, supply chain disruptions and changing consumer expectations), which are all generating demand for new goods and services across industries and regions.

Furthermore, adopting STEM skills for girls in technical, vocational and general education is imperative. According to the WEF Future of Jobs Report, it is important to instigate soft skills such as analytical thinking, creative thinking, marketing and media, AI and big data, service orientation and customer service, technological literacy, leadership and social influence.

What’s more, gender forward practices should include stronger campaigning for greater investment into female-run venture capitals (VCs) and encouraging more women to establish VCs themselves. Women tend to be concentrated in the Impact rather than the Investment teams of VCs. Also, applying a gender lens to climate finance cannot be over emphasized, and strengthening business women associations as platforms for peer to peer knowledge sharing and learning as well as providing client voice and networking opportunities is key. Supporting female led small business is also crucial since women tend to be risk averse and less aggressive with growth plans and might need more tailored women centric products.

Source: USAID. (2021). Gender Lens Investing Landscape Gaps, Challenges, and Opportunities in Financial Inclusion for Women