The Egyptian economy has witnessed a huge deterioration over the past couple of years with several rounds of currency devaluation, high inflation, negative investment sentiment and, lately, huge speculation in the parallel market, along with a shortage of some key goods. The first few weeks in 2024 were very gloomy with maniacal speculations about the future of the economy and a potential collapse of the Egyptian pound (EGP).

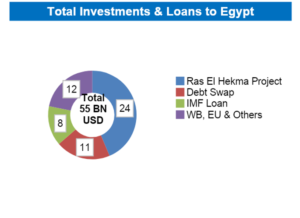

Then out of the blue, the Ras El Hekma deal was announced with a $35 billion investment, including $24 billion for the project itself, and $11 billion as debt swap. That move was enough to contain the speculation in the parallel market and send positive vibes across the economy. A few days later, the long-awaited International Monetary Fund (IMF) deal was announced with a total package of $20 billion from IMF, World Bank and the European Union (EU), after some tough, albeit expected decisions were made, such as the devaluation of EGP to 50 per $1 in banks along with CBE’s hiking interest rates by 6%.

The two deals of Ras El Hekma and the IMF, the devaluation, and hiking interest rates, along with expected mega deals with other Gulf countries saved the pound from a currency meltdown and provided a lifeline to the ailing economy. We would not be exaggerating if we said that we were safely moved from the intensive care unit to a regular room, though the economy still needs close observation due to the many chronic diseases it is suffering from.

The two deals of Ras El Hekma and the IMF, the devaluation, and hiking interest rates, along with expected mega deals with other Gulf countries saved the pound from a currency meltdown and provided a lifeline to the ailing economy. We would not be exaggerating if we said that we were safely moved from the intensive care unit to a regular room, though the economy still needs close observation due to the many chronic diseases it is suffering from.

Despite the structural problems, we can expect a couple of good years ahead, with a stable exchange rate, contained inflation and back-to-normal business activity. However, despite this positive outlook, people still can’t feel a tangible improvement, with prices still high and rising, and many key products still unavailable in market. Here comes the critical realization: the economy needs a big adjustment phase to cope with the new situation.

The big adjustment phase is a natural consequence of the long turbulent past phase that witnessed an overshooting of the exchange rate in the parallel market. The adjustment phase is expected to last for few months until the remaining mega deals get announced, the tough economic decisions like raising energy prices get executed, the exchange rate gets stabilized, the private inflows of foreign currency return to the market and the huge backlog of imported products accumulated at the ports gets cleared.

The adjustment period will be quite turbulent with so many irregularities. It will take production capacity some time to go back to normal. This probably won’t happen before the end of the adjustment phase. That means that some key products will stay in short supply for another few months until supply chains return to normal operation.

Prices will be the real dilemma. Prices of fully imported goods will go down but only after the backlog in ports and the accumulated goods in warehouses that were priced at very high exchange rates get cleared out. As for local products, prices will stay high and may even go higher due to the shortage of supplies and raw materials. But as the adjustment unfolds, general prices should stabilize, and inflation should eventually be tamed.

What does this mean for different stakeholders?

For companies, it is essential to rethink the cost structure and pricing model in a realistic manner, clearing out the old inventory with its different costs, closing the different commitments with irregularities, and considering the cost of financing at the heightened interest rates.

For households, it makes sense to delay purchase decisions, especially of imported goods, until repricing takes place.

For investors, major assets repricing shall take place across various asset classes as the market grasps the new situation and adjusts to the new inputs, so a wait-and-see approach is probably wise, instead of running to dump some assets and buy others.

Bottom line, the latest developments are definitely great news and provide a lifeline to our ailing economy. But to enjoy the upside, even in the short term, a tough adjustment phase is imperative. While in the long term, it all depends on implementing a real change in the adopted economic policies.

This article was written by Omar El-Shenety, Managing Partner at Zilla Capital and Adjunct Faculty at the American University in Cairo.