Listen to the article

On my way to an industrial area in Western Germany namely Munich, I had this conversation with the managing director of an old German company founded in 1921. He had been appointed to this job subsequent to the acquisition of a private equity firm to an old adhesive company which was once a family business. One can never forget his words “The first Generation builds, the second generation maintains and the third one destroys”. This small quote summarizes a reality that businesses –family owned or otherwise- are challenged with: How to continue long term?

The opening case is an example of the predominant story for family businesses which have been either sold or acquired or witnessed their sales slide significantly in the past years or across generations. Family business researchers have pinpointed many reasons underlying this phenomenon: businesses mature; markets and technology change, eliminating the need for various products and services; suppliers and customers alter the rule of the game or competitors quickly copy successful strategies. Any of these changes can represent a substantial surprise to a company that can bring its sales and profits towards a decreasing trend. In other cases, industry consolidation makes a strategic buyer willing to pay a premium than what the company is actually worth on a stand-alone basis. The senior generation facing retirement or other life events might be unable to resist the lure of the money and decides to sell.

Having spent eighteen years in the family business, I can say that the most unique feature of a family business is the continuous friction between loved ones and business interest. How can one separate the relationship between a boss at work and a father at home? In reality, families and businesses come with different goals. Families are concerned about emotions; they focus inward and generally they resist change.

Business systems must take an opposite approach if they are to survive- accomplish tasks, focusing outward on the external environment and looking for ways to exploit change.

Having this said, therefore, this article proposes that trying to separate the family from the business might not be the right avenue to take but rather the harmonization and balance in this relationship might be a better solution. Family members can be either a great strength or a potential weakness for the family business. In the case families are able to equalize the family and the business systems they will earn the potential of creating a positive environment where the family thrives, and the business performs.

This balanced approach of addressing these two subsystems will be the foundation of the point I am making in this article, embracing the Parallel Planning Process (PPP) suggested by Randel Carlock and John Ward, both of which have extensive research and practical experience in the area of family business.

The Parallel Planning Process (PPP)

The Parallel Planning Process is a proposition that expands on the traditional model of family business with the development of a viable business strategy as the ultimate outcome but shaped by the concerns of the family. It hence becomes a tool for integrating and balancing the family and the business thinking and action.

A huge challenge I faced and still facing within the family business is the unjustified resistance of a strong business plan that would serve as a guide for the business in the long term. I had always asked myself why wouldn’t they be interested in whatever I try to forge, despite spending hours on its preparation in collaboration with other family members and employees within our firm. I haven’t been able to reach a reasonable answer to my question until I stumbled upon the Parallel Planning Process major propositions.

The parallel approach is founded on four premises:

1. Family values and business philosophy are the foundation for the planning process.

2. Strategic thinking has implications for the family as well as for the management team.

3. Successful families and businesses are driven by a shared future vision

4. Long-term family businesses require formulating FAMILY and BUSINESS plans.

As can be seen from the above premises the goal of the PPP is to identify family and business plans that are mutually supportive of the other’s needs and goals. This is accomplished by considering business strategies in the context of both the family and the business expectations.

The ultimate goal of the business plan remains the development of strategies to create long-term economic value for the stakeholders. In this sense the PPP uses a series of planning and programming activities that lead the family and management to a business strategy that matches the family’s interests and the business potential. Strategic thinking by the family and the management team leads to their mutual agreement to a shared future vision. Based on this vision, both systems begin their respective planning activities leading to the development of the family enterprise continuity plan and the business strategy plan.

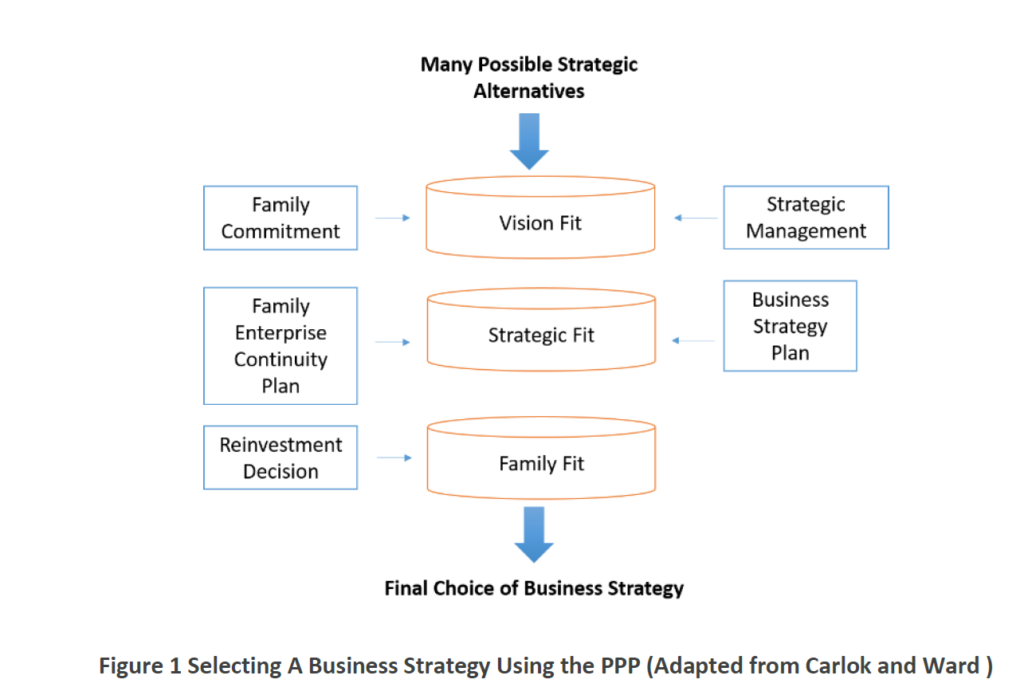

The figure below suggests how the PPP would look like if drawn as a logical sequence of activities. Possible strategy alternatives are the subject to three decision filters that the PPP creates.

• The Vision Fit reflects the interaction of the family commitment and management strategic commitment.

• The Strategic Fit is based on the business strategy plan and the family enterprise continuity Plan

• The Family Fit reflects the family’s reinvestment decision

The three screens ensure that a business strategy is aligned with the overall goals of the family. The first screen focuses on the shared vision. At this point the question is: Does the possible business strategy support both the family’s and management’s shared future vision? This screen will filter many of the options because they simply do not lead to a vision embraced by both the family and management. The second screen focuses on the strategic fit of the possible alternatives based on family and business planning. The family enterprise continuity plan looks at the family participation, management and leadership development and ownership. The business strategy plan considers the internal and external environments, the firm’s strategic potential and which strategies best match with the firm’s strategic potential. Alternatives that pass through this filter will be only a few under consideration. The third screen ensures that the final strategy best fits the family.

This suggests that family members as well as the management team are exploring simultaneously the family and business systems. This form of collaboration will definitely yield new ideas and will also establish a shared understanding of the family business values, goals, strengths, weaknesses, opportunities and potential threats. The real value of this exercise lies not in the piles of resultant documents but rather in the rich and open group discussions and thinking.

This Parallel Planning process is far from rosy nor achieved without obstacles since many can get in the way. Some of these obstacles relate to senior generations, others exist within the minds of successors and finally some obstacles arise from spouses and other stakeholders.

For instance, formal or even informal attempts at planning can be perceived as a threat to senior generations of family leaders. For many senior family members, this means sharing power and information which they would rather keep to themselves. They might object planning because it is time and effort consuming. They might even have some doubts regarding younger generation’s capabilities.

As for the next younger generations, they may lack the knowledge of what the family expects from them and can be overwhelmed with self-doubt about their capability to lead the business in the next level.

Finally, one cannot ignore the role of spouses in the family. Often, the female spouse may raise issues about her financial security. Added to this, are non-family employees and other stakeholders such as professionals service providers who may also have a personal stake in maintaining the status quo.

Given all these obstacles, identifying them will enable the family to explore what planning means to various stakeholders in the family enterprise and that process will stimulate ideas for actions to help overcome them. Some of the suggestions to overcome these obstacles might be to create meaningful career opportunities for family members within the business and identify a clear roe for them that will contribute to the firm. Also, the family must support family meetings to HONESTLY explore their level of commitment and vision. There is also a need to create family and business governance structures to avoid conflicts and to ultimately develop a future lifestyle plan and financial plan that could be communicated to various family members.

One final word remains…… At the base of all the previous suggestions and propositions, openness, honesty and integrity should be the pillars for proper family business plan. The family business is a term that encompasses two inseparable words: the family and the business, and hence planning must assure the marriage of both words!!

______________________________________________________________

Hakim Meshriki, Ph.D., is an assistant professor of marketing and CEMS-MIM academic director at the AUC School of Business. Meshriki is also CEO of Mena Company for Adhesives Technology “Menatec”, his family-owned Egyptian company since 1972.