Listen to the article

“AI” is probably the most used acronym in the world right now. It is being discussed everywhere, with huge hopes for a better future. In reality, AI offers a bright future with so many applications capable of undertaking tasks efficiently and opening new frontiers. It is not an exaggeration to say that AI is nothing short of revolutionary. But interestingly enough, it’s still developing exponentially, so its full potential is yet to unravel.

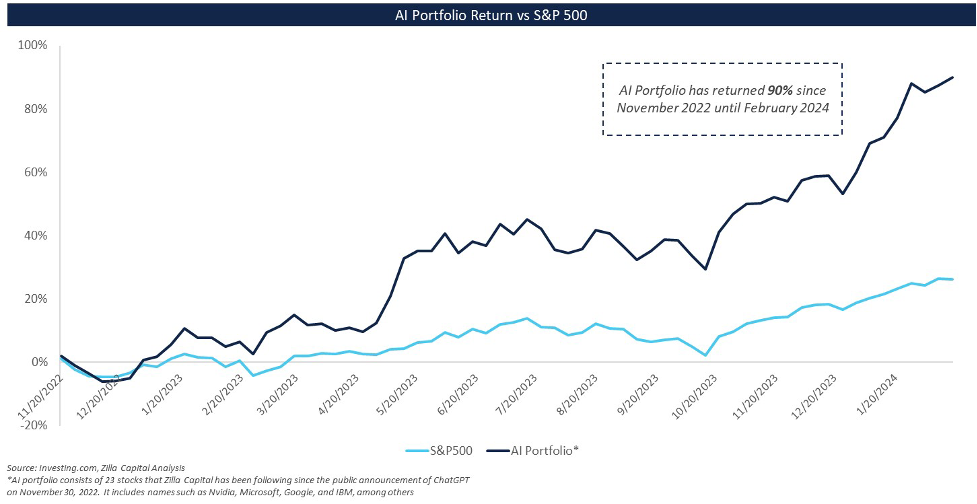

AI is not the first disruptive invention that the world has witnessed. All previous inventions like computers or the internet have changed our lives over the past few decades, but AI will probably impact our lives in a much deeper way and at a much faster pace. Looking at AI from an investment perspective in terms of the performance of companies that develop AI platforms or applications, AI-related stocks have outperformed the market index in the US by a wide margin. Additionally, investors are pouring money into private global AI companies at an unprecedented scale. Investing in AI companies has turned into an investment frenzy. “Anything AI” seems to have worked quite well lately.

Betting aggressively on AI stocks and pouring money into AI private companies is a growing trend for investors right now, and they have a good reasoning behind it. But the race to dominate the AI field and become the platform of choice is a critical race, and is one where the winner takes all, like Microsoft’s domination of PC operating system and Google’s domination of search business engines, thus replacing the old industrial mammoths and presenting themselves as the world’s largest companies. Being smart enough, big techs have always embraced the latest technologies such as smart phones and cloud computing. That helped them expand and became much bigger. Nowadays, they seem to be adopting the same approach with AI.

The investment boom in AI is rationally justifiable given the huge potential of AI. But like the dotcom bubble, the AI investment boom will likely be followed by a bust as the perception of AI companies overshoots and strays far from reality. While the AI investment boom is rational, its bust in the foreseeable future is inevitable, like the dotcom boom and bust. Still, AI is for real and will change our lives, but that was also the case with the internet. The investment frenzy that started last year will probably sustain for few more years before a market correction. This will perhaps happen when the winners of the race get crowned, losers get out of the market and many in-progress companies and projects get shelved.

It is risky to invest when you don’t know who will win the AI race, but it is even riskier not to invest in AI at all. Therefore, most investors will end up investing, and unfortunately many will go for “anything AI” as their investment strategy. This will be very prevalent in developed public markets especially US stock market but also in the venture capital (VC) and startups arena where “AI” is becoming an imperative theme for startups. Inflows of funds in AI companies will stay high for few years. But the winner-takes-all type of race entails many losers and so much wealth wiped out.

Betting on the big techs that invested in AI seems like a safe option, but there are also other listed contenders that are making strides. When it comes to private AI companies, things can be a lot trickier. Some of those companies could be the next big thing or even get acquired by the big techs, but many will end up shutting down. Because of the competition with the big techs, investing in small AI companies can be riskier than the usual investment in new technology startups. Moreover, startups that center their offerings around integrating AI tools will face huge pressure as established companies adopt such tools and re-dominate the market. So “anything AI” can’t be a rational investment strategy going forward.

Bottom line, AI is a reality and will alter our lives beyond our imagination. But investing in AI is a different story. While it can be attractive to jump into the AI investment boom, it is critical to realize that such a boom will have to be followed by an inevitable bust, making the “anything AI” an irrational investment strategy. A realistic approach is needed, especially in a winner-takes-all market where the big techs are leading the AI wave.

Omar El-Shenety

Managing Partner at Zilla Capital and Adjunct Faculty at the American University in Cairo